Germany’s banking market has long been divided between traditional banks with fees and fintechs with limited features. C24 Bank bridges this gap perfectly. Built by the CHECK24 group, it combines the digital speed of a neobank with the trust and features of a full German bank—and it pays you interest on your checking account.

“Finally, a checking account that pays you, rather than you paying for it.

If you are looking for a primary bank account that helps you budget better and grow your savings automatically, C24 is currently the strongest contender in the German market.

Why Switch to C24?

Most free bank accounts strip away features. C24 does the opposite. Even the free "Smart" account includes features that other banks charge for, like sub-accounts with dedicated IBANs and instant SEPA transfers.

Open your free C24 account

Get interest on your balance, 4 free Pockets, and a free Mastercard. Sign up takes less than 10 minutes.

Fully regulated German bank account.

Organize Money

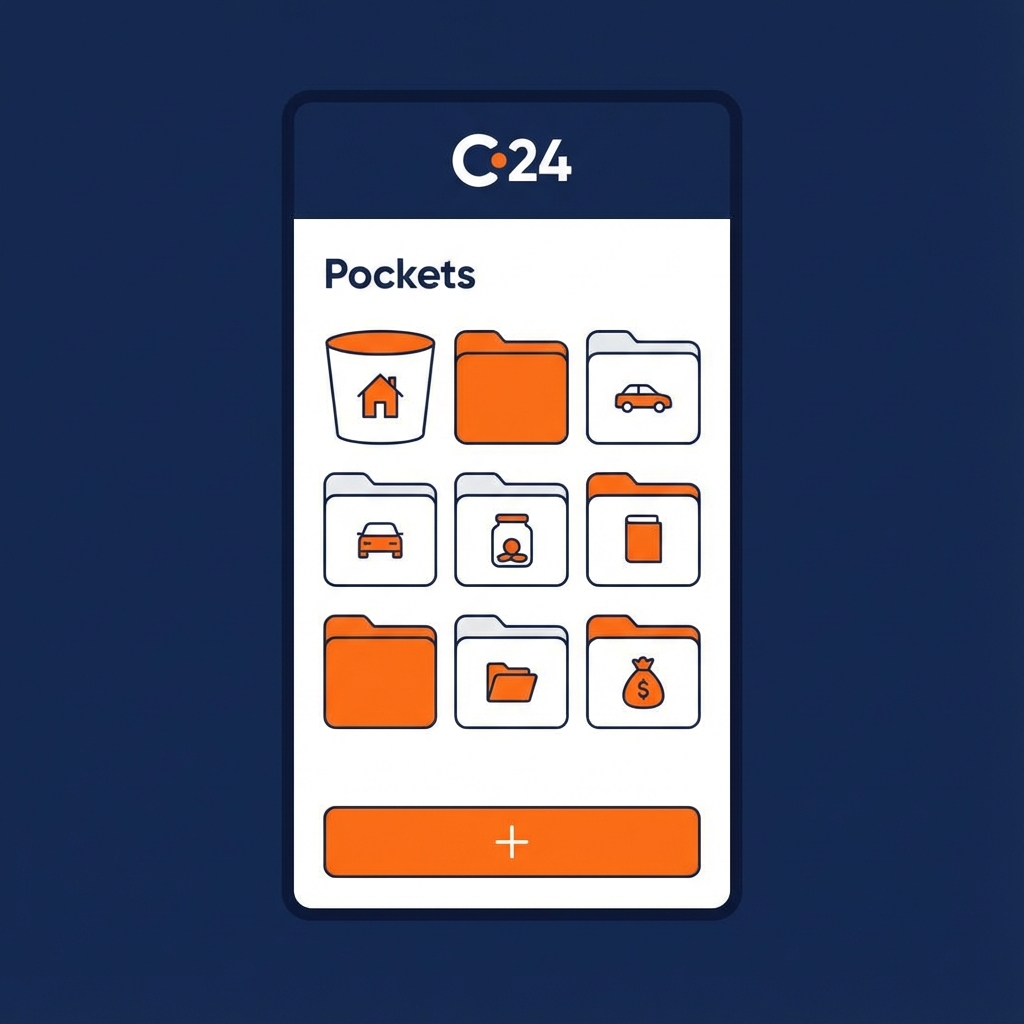

Pockets: The Budgeting Superpower

Most banks offer sub-accounts, but C24 gives them their own IBANs. This means you can pay bills directly from a "Fixed Costs" pocket.

Own IBANs

Direct debit your rent or internet bill straight from a dedicated pocket.

Savings Interest

Earn interest on every connected pocket and your main checking account.

Detailed Feature Breakdown

1. Interest on Everything

Unlike traditional banks that pay 0% (or less) on checking accounts, C24 pays interest on your daily balance. This applies to both the main account and your pockets. It's a great way to fight inflation with zero effort.

2. Multi-Banking and Contracts

Since C24 is part of the CHECK24 ecosystem, the app is brilliant at analyzing your contracts.

- Contract Recognition: It automatically identifies your electricity, insurance, and internet contracts.

- Optimization: It suggests cheaper alternatives if you're overpaying (optional, but handy).

- Multi-Banking: You can link your other bank accounts (Sparkasse, Deutsche Bank, etc.) to see all your finances in one app.

3. Free vs. Paid Models

- Smart (Free): Includes account, card, 4 pockets, and interest. This is sufficient for 90% of users.

- Plus (€5.90/mo): Adds insurance protection, more pockets, and higher cashback.

- Max (€9.90/mo): Full metal card, extensive travel insurance, and priority support.

Pros and Cons

Pros:

- Interest: Earning money on your checking account is a huge plus.

- Pockets: The IBAN feature for pockets makes budgeting automated and robust.

- User Experience: The app is fast, modern, and reliable.

- Instant Transfers: Free SEPA Instant transfers.

Cons:

- Cash Deposits: Partner shops charge a fee for depositing cash (via Barzahlen.de).

- Language: The app is currently German-first. Support speaks English, but the UI is German.

Conclusion

If you live in Germany, C24 Bank is arguably the best "all-rounder" bank account available right now. It combines the best features of fintechs (great app, free instant transfers) with the stability of a German banking license and interest rates.

For a free account that actively helps you manage your money better, C24 is our top recommendation.

Ready to upgrade your banking?

Open your C24 Smart account today and start earning interest on your daily spending money.